The UAE provides a powerful platform for new ventures to thrive, supported by strategic government initiatives, tax advantages, and access to international markets. However, many entrepreneurs overlook essential administrative and legal processes. Startup Admin Mistakes UAE continue to derail new ventures, often due to a rush to get started or misunderstanding of local regulations.

Start smarter—avoid these costly admin mistakes in UAE and give your company a clean and confident start.

Why New Businesses in UAE Need to Tread Carefully

The Rapid Rise of Startups in the UAE

With initiatives like “Project of the 50” and flexible visa options, the UAE is seeing an exponential rise in startup activity. Entrepreneurs from industries such as digital marketing, real estate, and solar energy are entering the market at an accelerated pace.

Common Blind Spots for New Entrepreneurs

In this booming landscape, many founders unknowingly skip essential legal and admin steps. They confuse operational planning with legal compliance or trust unverified advice. These gaps are not minor; they can result in fines, license cancellation, or legal disputes.

Outlook on UAE’s Economic Landscape

The UAE’s GDP has been on an upward trend, especially in non-oil sectors like entertainment, tech, and investment. With such opportunities comes the need for tighter business compliance. The business setup journey must be treated as a long-term strategy rather than a quick launchpad.

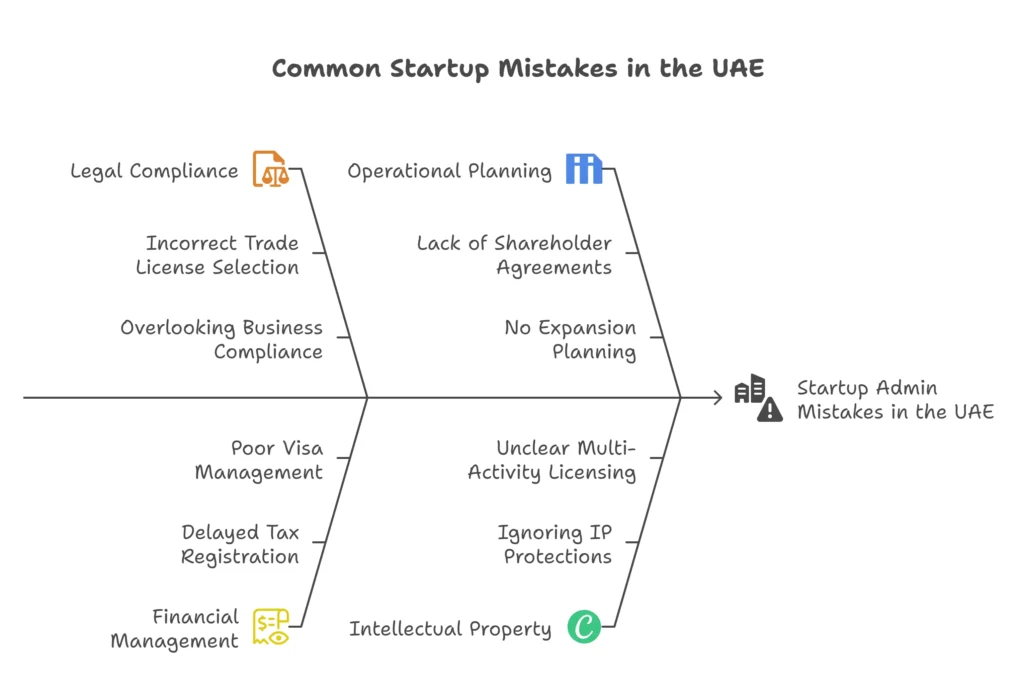

Understanding Startup Admin Mistakes in UAE: A Quick Overview

Fast Doesn’t Always Mean Right

Quick-fix company formation services might promise fast licensing, but they often overlook the long-term operational alignment required for sustainability.

Admin vs Operational Errors

While operational issues involve product-market fit or sales, Startup Admin Mistakes UAE are deeper. They involve misfiled documents, misaligned trade activities, or regulatory non-compliance.

Frequent Lapses and Their Consequences

Missing compliance deadlines or using the wrong license can affect your ability to open bank accounts, receive payments, or even operate legally. These lapses can hurt both your finances and reputation.

Most Costly Startup Admin Mistakes UAE Entrepreneurs Make

Launching a new company in UAE can be rewarding, but several startup admin mistakes UAE founders make can lead to legal trouble, delayed growth, or financial penalties. Here’s a streamlined guide to the most common pitfalls to avoid.

1. Incorrect Trade License Selection

Choosing the wrong license type or adding unrelated activities can restrict operations and complicate renewals.

E.g., a tech startup wrongly selecting “general trading” can face inspection issues and banking delays.

2. Lack of Shareholder Agreements

Many partnerships begin informally, skipping clear terms on ownership, roles, or exit rights.

Without an agreement, investor discussions or partner exits become risky and legally complex.

3. Misunderstanding Local Sponsor Clauses (LLC Setup)

LLC founders often misunderstand sponsor rights, leading to future disputes. Define roles, profit sharing, and control clearly in writing.

4. Ignoring Intellectual Property Protections

Registering trademarks, domains, or creative assets is often ignored early on.

Without protection, your brand may be copied with little legal recourse.

5. Overlooking Business Compliance Requirements

Late VAT returns, unfiled accounts, or missing documentation trigger penalties and damage business credibility.

FTA fines for late VAT filing start at AED 1,000.

6. Delayed Tax or VAT Registration

Many assume tax laws don’t apply to them. But if your business crosses thresholds, registration is mandatory—even in free zones.

Some free zone firms with local transactions must register for VAT.

7. Poor Visa and PRO Management

Missed visa renewals, wrong job titles, or missing records can halt hiring and attract fines.

Professional PRO services prevent costly labor-related delays.

8. Missed License Renewals or Amendments

Late renewals or outdated company details (like address or activity) attract heavy fines and may block future changes.

9. Unclear Multi-Activity Licensing

Combining services like consulting and trading under one license may not be permitted. Always check activity compatibility.

10. No Expansion or Exit Planning

Most startups don’t prepare for scaling or partner exits. A flexible legal structure helps when onboarding investors or shifting strategy.

Bonus: Not Staying Updated on Sector Regulations

Regulations change fast in UAE, especially for sectors like solar, media, or trading. Ignoring updates creates hidden business compliance risks.

Subscribe to DED or MoF updates or consult regularly with experts.

Business Compliance Must-Knows for Any New Company UAE

Many startup admin mistakes UAE founders make are tied to missing or mismanaging basic compliance tasks. Here’s what every new company UAE must stay on top of from the beginning:

✅ Visa and PRO Service Management

Getting employee or family visas requires complete documentation—Emirates ID, labor contract, and medical reports.

For mainland companies, Emiratization rules are now mandatory and updated frequently.

Missing renewals or wrong job codes can lead to fines or processing delays.

✅ Licensing Renewals and Amendments

Trade licenses must be renewed every year without delay.

Any changes to your business address, activity, or ownership must be updated officially.

Unreported changes may block license renewals or trigger penalties.

✅ Corporate Tax and VAT Registration

New UAE tax laws apply to more businesses now.

Companies with over AED 375,000 taxable income must register for corporate tax and VAT—some free zones included.

Non-registration, even if accidental, can lead to penalties starting from AED 10,000.

✅ HR Records and Contracts

Employment contracts must meet UAE Labour Law and be registered with MOHRE.

Missing or vague contracts risk legal issues or staff disputes.

Inconsistent HR documentation is a hidden compliance threat many startups overlook.

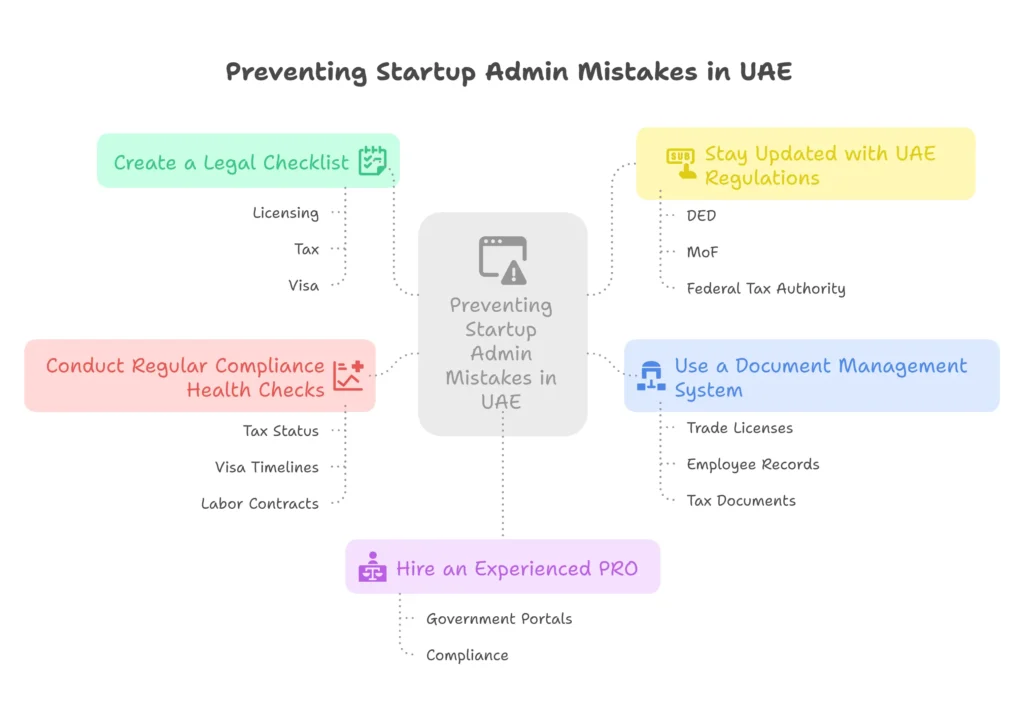

How to Prevent Common Startup Admin Mistakes in UAE

Avoiding startup admin mistakes UAE founders often face requires proactive planning and the right support. The following strategies help ensure that your new company UAE stays compliant and operationally smooth from day one.

✅ Create a Legal Checklist from Day 1

List every licensing, tax, visa, and reporting requirement your business must meet—and update it regularly.

This helps you track renewals, filings, and required documentation before deadlines become a problem.

✅ Hire an Experienced PRO or Consultancy Partner

Working with professionals who understand UAE’s legal processes reduces risks.

They help you navigate government portals, avoid missteps, and keep compliance on track.

✅ Stay Updated with UAE Regulations

Subscribe to updates from DED, MoF, and the Federal Tax Authority to stay informed.

Laws can change frequently—especially in areas like VAT, licensing, and Emiratization quotas.

✅ Use a Document Management System

Organize and store all trade licenses, employee records, and tax documents in one place.

Having everything easily accessible prevents missed renewals or audit issues.

✅ Conduct Regular Compliance Health Checks

Every quarter, review your tax status, visa timelines, and labor contracts for errors or expiry.

Periodic reviews help detect small gaps before they grow into major business compliance issues.

Strategic Business Tips for a New Company UAE

New entrepreneurs in the UAE can avoid many startup admin mistakes UAE businesses face by planning smarter from the start. These practical tips are designed to help your new company UAE set up on solid ground.

✅ Choose the Right Legal Structure

Whether it’s mainland, free zone, or offshore—each has different rules for ownership, operations, and tax.

Choosing the wrong setup can limit future growth, especially if you plan to serve both UAE and international markets.

✅ Align Business Activity with Trade License

Make sure your trade license activity matches what your business actually does.

Mismatch here can lead to penalties, renewal issues, or restrictions on advertising your services.

✅ Set Up a Business Bank Account Early

Opening a bank account in the UAE takes time and documentation, so plan it during the licensing phase.

Delay in banking setup can hold up client payments or payroll processing.

✅ Build an Accounting and Bookkeeping System

From day one, track expenses, invoices, and receipts using reliable software or a professional service.

Strong financial records help with VAT registration, audits, and future funding.

✅ Understand Industry-Specific Requirements

Some sectors (like real estate, education, healthcare, or marketing) need extra permits and approvals.

Missing these can block operations or trigger inspections that delay your launch.

✅ Appoint an Experienced Local Advisor

Having a UAE-based consultant or advisory firm helps you stay on top of changes in business compliance.

Their insights can save you from legal or administrative missteps common in early-stage businesses.

Leverage the UAE’s Business Ecosystem the Right Way

Mainland vs Free Zone

- Free zones offer 100% ownership but are restricted to specific sectors

- Mainland companies can serve wider markets

Sector-Specific Licensing

- Events require permits from DTCM

- Solar energy firms need approvals from DEWA and municipalities

Business Community Engagement

- Join local chambers and business councils

- Helps with compliance insights, networking, and opportunity access

What Most Founders Overlook: New Legal Risks in UAE’s Emerging Sectors

Rapid Law Updates in Expanding Industries

- Digital marketing firms must adhere to new ad licensing rules

- Tech and solar startups face dynamic compliance needs

Admin Gaps in Niche Fields

- Freelancers in entertainment require flexible permits

- Music event companies must maintain public performance rights

Multi-License Ownership Confusion

- Running multiple businesses under one license is restricted

- Better to set up holding companies or multi-activity structures legally

FAQs

What are the most common startup admin mistakes UAE founders make in year one?

Choosing the wrong trade license, not registering for taxes, and failing to renew documents on time are the top issues.

Can I change my trade license activity later?

Yes, but it requires DED or free zone approval and may involve documentation updates.

Do all businesses need to register for VAT in the UAE?

Only if your annual taxable turnover exceeds the threshold (AED 375,000). However, some sectors are required to register regardless.

How much does PRO service usually cost in Dubai?

It ranges from AED 500 to AED 5,000 per month depending on service scope and company size.

Do I need a local sponsor if I’m opening a digital business?

Not always. Some free zones allow 100% foreign ownership without a sponsor for digital businesses.

No comment yet, add your voice below!