Running a business in the UAE comes with opportunities, growth, and, of course, responsibilities. One of those responsibilities is facing audits—whether financial, compliance-related, or VAT-specific. For many entrepreneurs, the process can feel overwhelming. That’s where a detailed UAE Business Audit Guide becomes helpful, showing you step by step how to be ready and avoid last-minute surprises. Whether you’re preparing for Audit Preparation Dubai requirements or simply want clarity on a UAE Compliance Audit, this article is here to give you practical guidance.

Think of this guide as your audit preparation partner. We’ll cover the exact documents auditors expect, what they often question, and how to save time and money through better bookkeeping. We’ll also share industry-specific advice, because the audit process looks different for real estate, trading, or oil and gas companies. And before we go deeper—if you’ve ever thought, “Want a property for your business? Here’s how to get mortgage-ready”—that’s part of the bigger financial picture that connects directly to audit readiness.

Let’s break it down clearly and simply.

Why Audits Matter in UAE’s Business Landscape

Audits are not just about numbers on paper; they are about proving your company is reliable and transparent. UAE authorities require audits for many businesses, especially those that want to attract investors, apply for financing, or renew licenses.

- Investor confidence: Audited reports are often the first documents investors ask for before making commitments.

- Banking and financing: To secure loans or mortgages, banks usually request audited financial statements.

- Government requirements: Some free zones and mainland authorities mandate annual audits to ensure compliance.

- Tax and VAT transparency: An audit confirms that VAT filings, payroll records, and expenses are accurate.

When you view audits as an opportunity instead of an obligation, you see how they can strengthen your company’s long-term foundation.

Types of Audits in UAE & What They Cover

Not every audit is the same. Depending on your industry and structure, you may face one or more of the following:

Financial Audit UAE

This is the standard yearly audit required by many free zones and regulators. It reviews income, expenses, assets, liabilities, and ensures financial statements match accounting standards.

VAT Audit

Since VAT introduction in 2018, many businesses face VAT audits. Authorities review VAT returns, invoices, and purchase records to confirm the correct amount was paid and claimed.

Operational Audit

This goes beyond finances and looks at internal processes. For example, how efficiently your trading company manages supply chain expenses or how your real estate company tracks rental income.

UAE Compliance Audit

This focuses on whether your business meets local regulations, licensing conditions, and employment requirements. It often reviews HR, payroll, and labor laws alongside finances.

Knowing the type of audit you’re facing helps you prepare the right documents in advance.

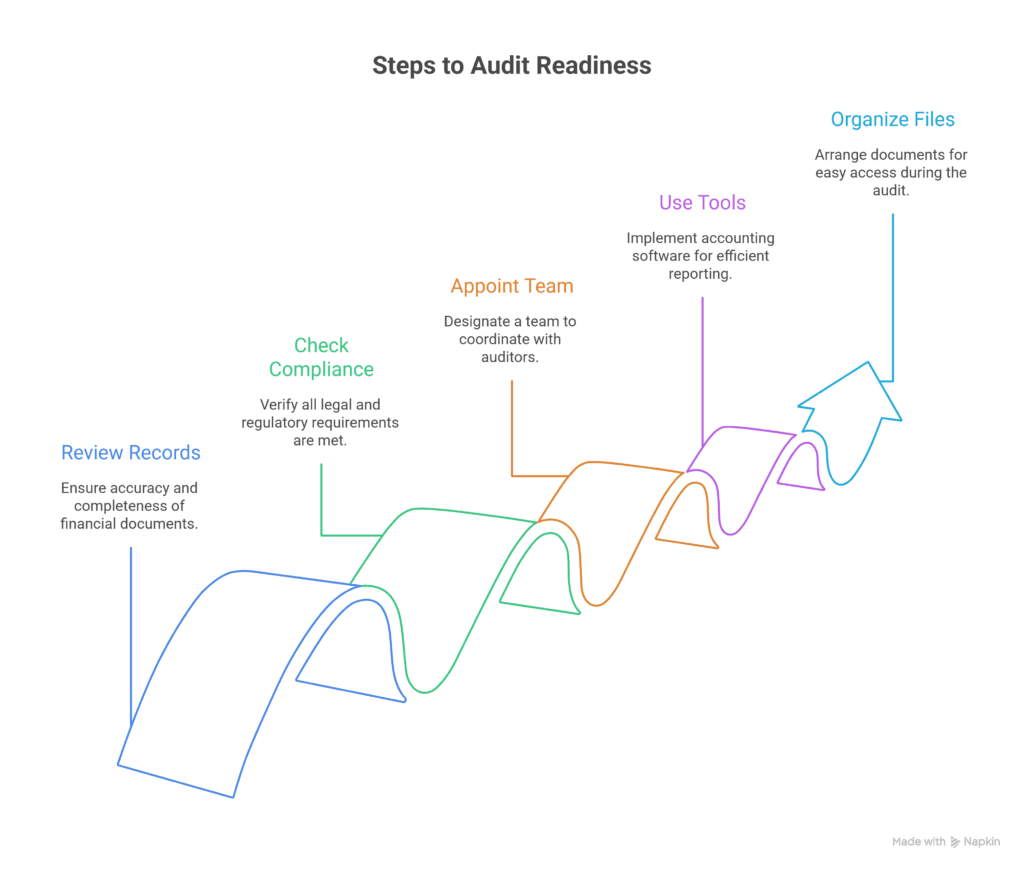

Audit Preparation Dubai: First Steps to Take

Preparing early makes the process smooth and stress-free. Here’s where to start:

- Review your records – Go through financial statements, VAT returns, contracts, and payroll records. Correct errors before the audit begins.

- Check your compliance status – Ensure trade license renewals, labor contracts, and immigration records are up to date.

- Appoint an internal team – Assign someone responsible for coordinating with auditors. A single point of contact avoids confusion.

- Use accounting tools – Many companies in Dubai rely on cloud-based systems for faster access to reports.

- Organize files – Keep both digital and physical copies of contracts, receipts, and invoices ready for quick access.

Not sure where to start with audit prep? Speak to our Dubai-based consultants today—we’ll make the process hassle-free.

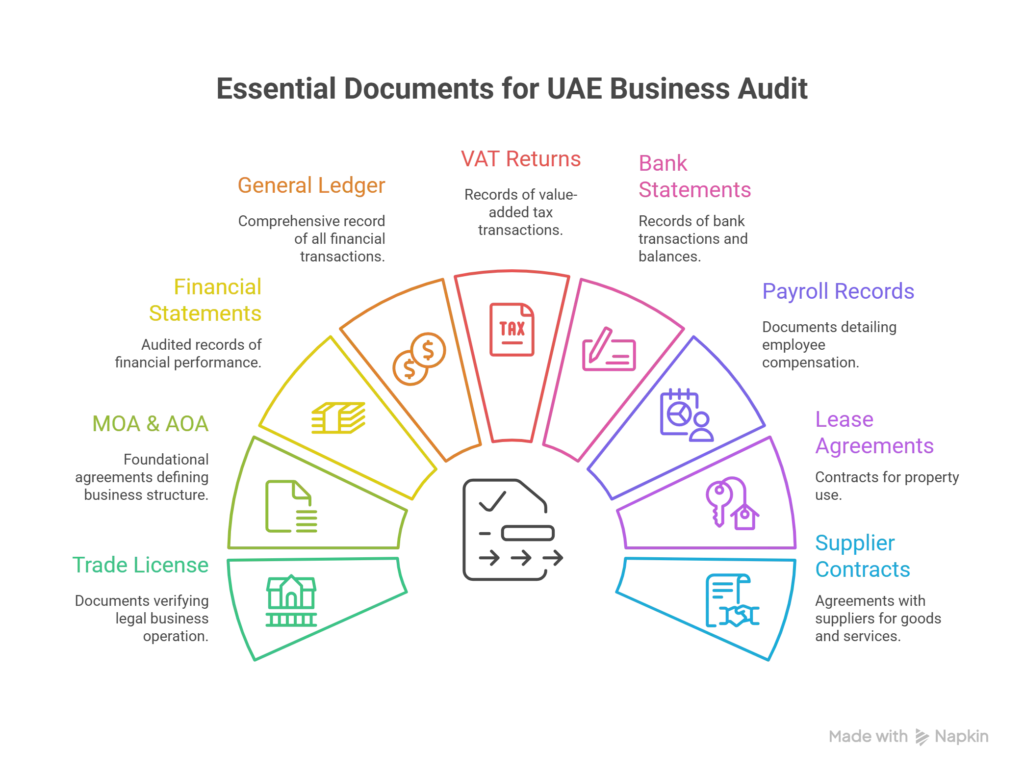

Checklist of Documents for UAE Business Audit

Auditors expect a structured set of documents. Missing just one can cause delays. Here’s what you’ll need:

- Trade license and incorporation documents.

- Memorandum of Association (MOA) and Articles of Association (AOA).

- Audited financial statements (previous year if available).

- General ledger and trial balance.

- VAT returns, invoices, and supporting documentation.

- Bank statements and reconciliations.

- Employee payroll and WPS records.

- Lease or property agreements.

- Contracts with suppliers and customers.

By preparing this checklist in advance, you make the auditor’s job easier—and reduce the chance of extended reviews.

Practical Audit Preparation Tips

Many businesses fail audits not because of major fraud but because of small mistakes. Let’s cover fresh, practical ways to stay ready:

- Update monthly – Don’t wait until year-end to prepare records. Monthly reconciliations make audits faster.

- Maintain dual copies – Keep scanned versions of invoices and contracts along with originals.

- Use professional bookkeeping – Outsourcing bookkeeping ensures clean, audit-ready accounts.

- Schedule mini-audits – Internal quarterly reviews spot mistakes before the real audit.

- Industry-based checks – A trading company should keep customs records up to date, while real estate firms must ensure tenancy contracts are documented properly.

These simple steps cut down audit stress and often save costs too.

Common Mistakes That Trigger Red Flags in Financial Audit UAE

Auditors are trained to spot irregularities. Here are the errors they often find:

- VAT mismatches – Input tax claimed incorrectly or missing VAT invoices.

- Payroll gaps – WPS non-compliance or missing employee records.

- Unrecorded cash transactions – Especially in trading and retail businesses.

- Personal expenses in business accounts – A common red flag.

- Asset depreciation errors – Incorrectly calculating depreciation on fixed assets.

Avoiding these mistakes can prevent fines and protect your company’s reputation.

The Role of VAT & Payroll Accuracy in Audit Success

VAT and payroll are among the most reviewed areas during audits.

- VAT checks: Authorities verify whether VAT collected from customers is correctly paid and whether VAT credits claimed are valid. Businesses often get flagged for claiming VAT on non-eligible expenses.

- Payroll accuracy: The Wage Protection System (WPS) in UAE ensures salaries are paid on time and as per contracts. Auditors check payroll files against bank transfers.

A mismatch in either VAT or payroll can lead to penalties, so regular cross-checking is recommended.

Staff Preparation for Auditor Meetings

Auditors often request interviews with staff to confirm processes. Your team must be ready:

- Finance team should be able to explain entries and reconciliations.

- HR department should confirm payroll and employee records.

- Operations staff may be asked about supplier contracts or inventory management.

Tip: Train your staff to be open and honest. If they don’t know an answer, it’s better to say so than to guess.

Reducing Audit Costs with Smart Bookkeeping

Audit fees often rise when accounts are messy. Here’s how to cut costs:

- Daily record keeping – Prevents auditors from spending extra hours fixing mistakes.

- Use accounting software – Reduces manual errors.

- Outsource bookkeeping – For SMEs, outsourcing is more cost-effective than maintaining an in-house team.

- Plan ahead – Booking auditors early prevents last-minute surcharges.

Lower audit stress and save money—let our experts manage your books while you focus on growth.

Industry-Specific Audit Readiness

Different industries in the UAE have unique audit requirements. Here’s how to stay ready:

Real Estate & Holding Companies

- Keep tenancy contracts updated.

- Ensure mortgage and property loan records are accurate.

- Maintain clear rental income documentation.

Trading & Import/Export

- Customs declarations and shipping invoices must be in order.

- Supplier contracts should match purchase orders.

- Inventory counts should be verified quarterly.

Digital Marketing & Professional Services

- Record income from multiple platforms or clients.

- Maintain contracts for consultancy and service agreements.

- Keep clear expense reports for ad spend.

Oil & Gas, Marine, and Project Management

- Compliance approvals for large projects.

- Accurate project financing and cost allocations.

- Contractor agreements clearly documented.

Tailoring audit prep to your industry ensures smoother audits and fewer queries.

“Want a property for your business? Here’s how to get mortgage-ready.”

Your business audit is often connected to financing decisions. Banks ask for audited financials before approving mortgages or loans. If you plan to expand or purchase property, keeping your accounts clean today will make tomorrow’s mortgage process easier. Our advisory team can guide you on both—Audit, Accounting and Book-keeping Services keep your growth on track.

FAQs – UAE Business Audit Guide

What is the difference between statutory and compliance audits in UAE?

A statutory audit checks financial statements against accounting standards, while a compliance audit reviews whether your business follows UAE laws and licensing rules.

How to avoid VAT penalties during audit?

Ensure VAT invoices are collected, matched with returns, and filed properly. Avoid claiming VAT on non-eligible expenses.

Can businesses request an extension for an audit in Dubai?

Yes, in some cases auditors can agree to extensions, but this depends on regulatory deadlines. Early preparation avoids such issues.

Is a financial audit UAE mandatory for startups?

Not all startups require audits immediately, but many free zones and investors request audited statements for credibility.

How often are audits conducted in Dubai?

Generally, companies undergo annual audits, though VAT audits or compliance checks can occur anytime if triggered.

No comment yet, add your voice below!