Dubai Business Setup Cost in 2025: What Every Founder Should Know

Thinking of launching your business in Dubai? The real costs often surprise founders—beyond the license fees, there’s more to consider.

Table of Contents

- Why Understanding Costs Matters in Dubai

- Step-by-Step Breakdown of Business Setup Costs

- Dubai-Specific Insights

- How AdeptBiz Consulting Helps

- FAQ Section

Why Understanding Costs Matters in Dubai

Dubai has rapidly become a global entrepreneurial hub. With corporate tax updates, Free Zone perks, and Mainland licensing requirements, knowing the actual cost of setting up your business is crucial. Proper planning ensures smooth operations, prevents surprises, and helps secure funding efficiently.

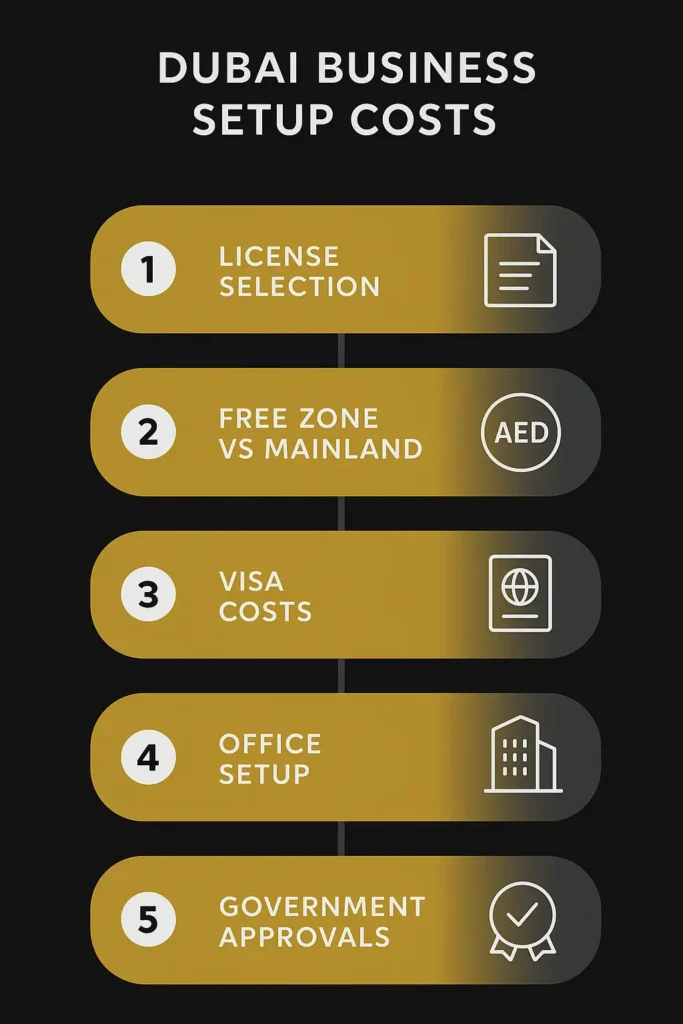

Step-by-Step Breakdown of Business Setup Costs

1. Choose Your License Type

Depending on your business activity, you may need a Commercial, Industrial, or Professional license. Each comes with its own fee structure.

2. Free Zone vs Mainland Decision

- Free Zone: 100% foreign ownership, tax exemptions, and simpler setup.

- Mainland: Greater market access, more flexibility with visas, but subject to corporate tax (9% above AED 375,000 profits).

| Type | License Fee (AED) | Office Costs (AED) | Visa Costs (AED) |

|---|---|---|---|

| DMCC | 15,000–25,000 | 15,000–20,000 | 5,000–7,500 |

| DIFC | 20,000–35,000 | 20,000–25,000 | 6,000–8,000 |

| Mainland | 10,000–20,000 | 15,000–25,000 | 5,000–10,000 |

Pricing Note: Prices may change depending on your business nature — contact us for more details.

3. Visa Planning and Costs

Consider the number of employees and owners needing residency visas. Free Zones often include visa quotas, while Mainland visas require MOHRE approvals.

4. Office Setup / Flexi Desk Fees

Flexi Desk packages are cost-effective for small startups. Full office leases vary widely based on location and size.

5. Government Approvals and Paperwork

Includes approvals from Dubai Municipality, MOHRE, and FTA for VAT registration. Additional fees may apply for certifications, name reservations, or external approvals.

Dubai-Specific Insights

- Free Zones: DMCC, DIFC, IFZA are popular, each with different benefits and visa quotas.

- Mainland Licensing: Provides access to UAE market; corporate tax applies on profits exceeding AED 375,000.

- VAT & Taxes: Businesses with turnover above AED 375,000 must register for VAT at 5%. Free Zones offer exemptions in most cases.

- Office Requirements: Flexi Desks and coworking solutions reduce overheads for lean startups.

How AdeptBiz Consulting Helps

At AdeptBiz Consulting, we guide founders through every step: license selection, visa planning, office setup, and government approvals. We help you avoid hidden costs and streamline your launch, letting you focus on growth, not paperwork.

👉 Talk to a Dubai Business Setup Expert

FAQ Section

Q1: Can I register my Dubai company remotely?

Yes, most Free Zones now allow full digital setup, enabling registration from abroad without physical presence.

Q2: What are the tax implications for startups in 2025?

Free Zone companies enjoy corporate tax exemptions. Mainland businesses pay 9% on profits above AED 375,000. VAT registration applies if turnover exceeds AED 375,000.

Q3: How long does the setup process usually take?

Setup time varies by license type and approvals, from a few days in Free Zones to 2–4 weeks for Mainland companies.

Ready to Start Your Dubai Business?

Let’s simplify your business setup journey. Email info@adeptbizconsulting.com today for expert guidance tailored to your business.

No comment yet, add your voice below!