Want a property for your business? Here’s how to get mortgage-ready.

Embarking on a real estate investment journey in the UAE requires a clear understanding of Mortgage Loan UAE Business options. For entrepreneurs aiming to secure Business Property UAE, navigating the landscape of Real Estate Financing is essential. This guide provides a structured approach to help you make informed decisions.

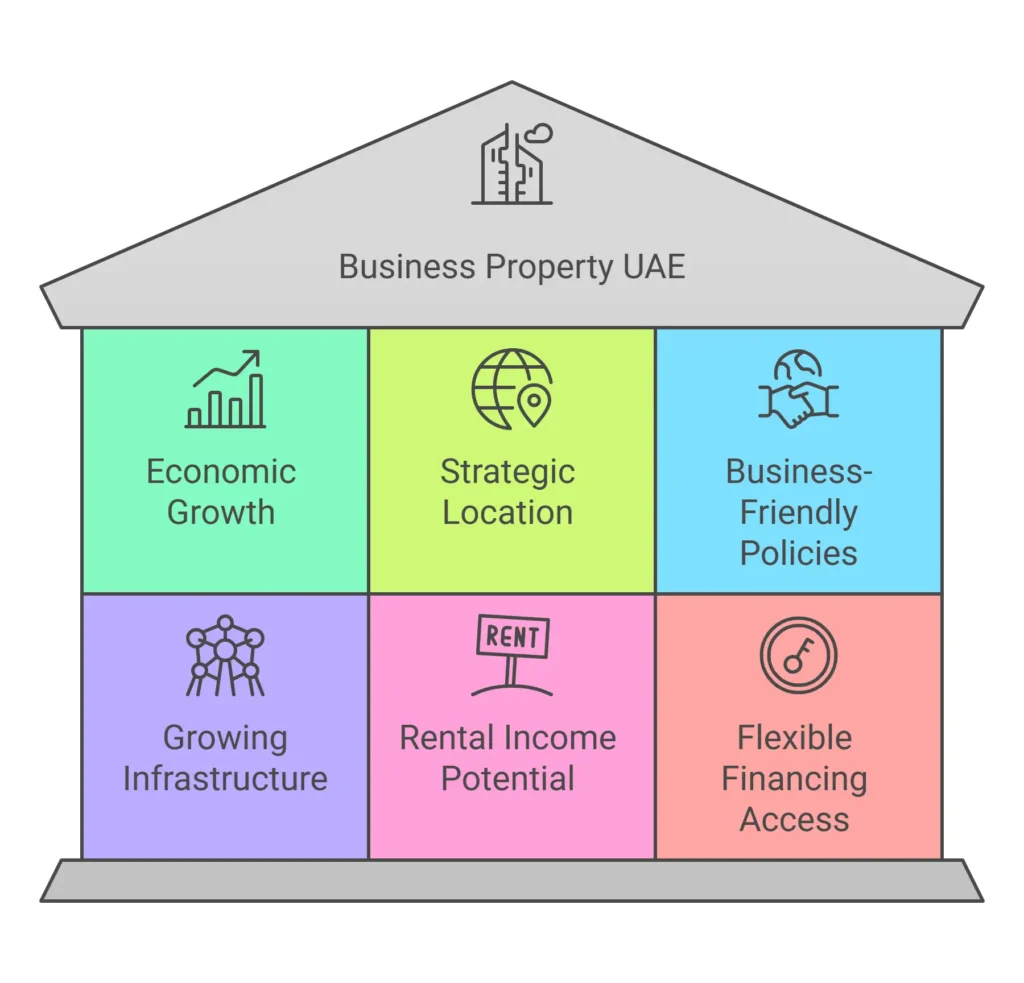

Why Entrepreneurs Are Investing in UAE Real Estate

The UAE’s dynamic economy and strategic location make it an attractive destination for business investments. Entrepreneurs are increasingly looking to acquire Business Property UAE to establish a physical presence, enhance brand visibility, and capitalize on the region’s growth.

- Economic Growth: The UAE’s diversification efforts have accelerated non-oil sectors, boosting business confidence and demand for business property UAE.

- Strategic Location: Positioned between Europe, Asia, and Africa, the UAE offers entrepreneurs unmatched trade connectivity and a strong case for real estate financing.

- Business-Friendly Policies: Reforms such as 100% foreign ownership, long-term visas, and simplified licensing attract investors to explore mortgage loan UAE business options confidently.

- Growing Infrastructure: Modern logistics, smart cities, and transport projects increase the commercial value of properties—making real estate a smart business asset.

- Rental Income Potential: Demand for commercial units in business hubs ensures steady rental yields, allowing owners to benefit from both occupancy and investment returns.

- Flexible Financing Access: Entrepreneurs now enjoy easier access to tailored real estate financing, including Islamic mortgage structures and SME-focused loans.

Understanding Mortgage Loan UAE Business Options

Choosing the right mortgage loan UAE business plan is key for entrepreneurs looking to invest in commercial spaces. Here’s a simplified look at your main financing options:

Commercial Mortgages

Used for buying offices, warehouses, or retail units, these loans support direct business operations.

They offer long tenures and allow businesses to use or rent out the business property UAE for steady income.

Islamic Financing

Murabaha and Ijarah follow Sharia law and avoid interest-based lending.

They suit entrepreneurs looking for ethical real estate financing with structured, transparent payments.

Free Zone Property Loans

These are available for buying units in free zones, offering 100% foreign ownership.

Ideal for startups seeking flexibility and lower compliance hurdles.

Loan-to-Value Ratios

Banks typically finance up to 70–80% of the property cost.

Higher LTV is possible for well-established businesses buying prime commercial property.

Need assistance in choosing the right mortgage option? Our experts are here to guide you.

Key Eligibility Criteria for Entrepreneurs

Before applying for a Mortgage Loan UAE Business, ensure you meet the following criteria:

- Business Registration: Your company should be legally registered in the UAE.

- Financial Statements: Provide audited financials for the past 2-3 years to demonstrate stability.

- Credit History: A good credit score enhances your loan approval chances.

- Down Payment: Be prepared to contribute 20-30% of the property’s value.

Entrepreneur-Focused Real Estate Financing Strategies

To maximize the benefits of Real Estate Financing, consider the following strategies:

- Leverage Business Assets: Use existing assets as collateral to secure better loan terms.

- Diversify Investments: Invest in properties that can serve multiple purposes, such as combining office space with rental units.

- Long-Term Planning: Align property investments with your business’s growth trajectory to ensure sustainability.

Strategic Planning: Mix Your Capital with Real Estate Financing

Smart entrepreneurs don’t rely solely on cash—they use real estate financing to expand faster and preserve working capital. Here’s how to plan wisely:

✅ Equity + Financing Combo

Using both personal funds and a mortgage loan UAE business allows better control while keeping reserves for other business needs. It lowers upfront burden and makes property investment more sustainable.

✅ Maintain Liquidity

Avoid locking all funds into one asset—real estate is long-term. Combining financing ensures liquidity for operations, marketing, or unforeseen costs.

✅ Maximize ROI

Leverage lets you invest in higher-value business property UAE, improving potential rental yields and capital appreciation. More capital, better location—higher long-term value.

Preparing for Loan Approval: What Banks Expect from Business Buyers

To enhance your loan approval prospects, focus on the following:

- Comprehensive Business Plan: Detail your business model, revenue projections, and how the property will be utilized.

- Financial Health: Maintain clean financial records and demonstrate consistent profitability.

- Collateral: Offer additional security to mitigate the lender’s risk.

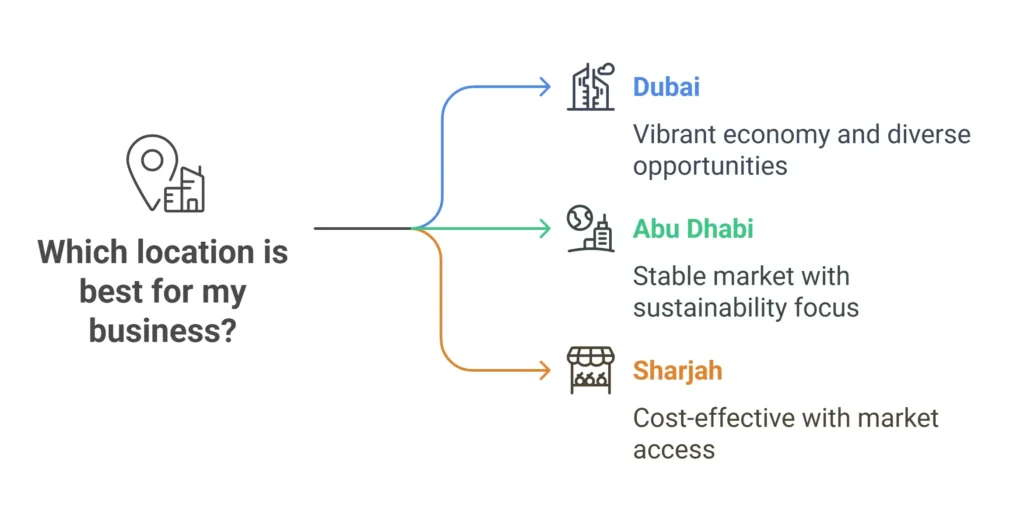

Top Locations to Buy Business Property in UAE

Selecting the right location is crucial for your business’s success:

- Dubai: Known for its vibrant economy and diverse business opportunities.

- Abu Dhabi: Offers a stable market with a focus on sustainability and innovation.

- Sharjah: Provides cost-effective options with access to key markets.

Our real estate advisory services can help you identify the ideal location for your business.

Navigating Legal, Tax, and Compliance Aspects

Understanding the regulatory landscape is essential:

- Legal Framework: Ensure compliance with property ownership laws and business regulations.

- Taxation: Be aware of VAT implications and other tax obligations related to property ownership.

- Compliance: Maintain transparency in financial reporting and adhere to anti-money laundering laws.

Common Mistakes Entrepreneurs Make While Applying for Mortgage

Avoid these pitfalls to ensure a smooth mortgage process:

- Inadequate Preparation: Failing to gather necessary documents can delay approval.

- Overleveraging: Taking on excessive debt can strain your business finances.

- Ignoring Market Trends: Not researching property values and market conditions may lead to poor investment decisions.

Tools & Support: Services That Simplify the Process

Our comprehensive services are tailored to support your investment journey:

- Business Set-up and Company Formation: Establish your business entity with ease.

- Visa and Immigration Services: Navigate residency requirements seamlessly.

- Audit, Accounting, and Bookkeeping: Maintain accurate financial records.

- VAT/Tax Advisory and Compliance: Stay informed about tax obligations.

- Administrative and Business Advisory: Receive strategic guidance for business growth.

- Arranging Bank Facility and Project Financing: Access tailored financing solutions.

- Real Estate Advisory and Mortgage Loan: Find the right property and secure financing.

Let us handle the complexities while you focus on growing your business.

Frequently Asked Questions (FAQ)

Can I obtain a mortgage for Business Property UAE as a foreign entrepreneur?

Yes, foreign entrepreneurs can secure mortgages, provided they meet the bank’s eligibility criteria and provide the necessary documentation.

What types of properties are eligible for Mortgage Loan UAE Business?

Commercial properties such as offices, warehouses, and retail spaces are typically eligible.

How long does the mortgage approval process take?

The timeline varies but generally ranges from a few weeks to a couple of months, depending on the complexity of the application.

Are there any restrictions on property locations for business mortgages?

Some banks may have preferences or restrictions based on the property’s location, so it’s essential to consult with your lender.

What is the typical interest rate for business mortgages in the UAE?

Interest rates vary based on the lender and the borrower’s profile but generally range between 3% to 5%.

No comment yet, add your voice below!